17 Avr Julien Duboué, le doux Chef doué

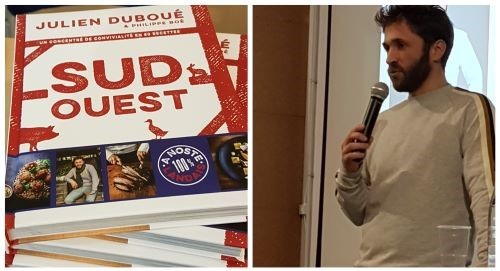

Passionné, débordant d’idées et d’envies, Julien Duboué, le doué Chef aux 5 restaurants, nous a, le jeudi 17 janvier, remué le cœur et les tripes. Comme il remue la terre pour cultiver des produits dans sa région natale et les amener presque directement sur les tables de ses restaurants parisiens.

Il a captivé son auditoire, 180 Jeunes Dirigeants, venus avec leurs collaborateurs, clients et conjoints au Château de Nanterre, un centre ETIC. Un lieu choisi avec soin par le CJD 92 (Centre des Jeunes Dirigeants) qui organisait la plénière annuelle du Grand Paris.

Le Château de Nanterre, nouveau laboratoire de l’innovation sociale et de la transition alimentaire en Ile-de-France. Un lieu en harmonie avec le thème de notre conférence « Entreprenariat & passion : comment produire sainement, comment manager par la confiance et le sens ».

« Notre projet de mandat c’est d’être activateur économique et social », a introduit Sylvain Chapuis Président du CJD 92. Le dirigeant développe au CJD sa posture sociale et responsable, il peut choisir une manière différente de développer son entreprise : par l’attention portée aux collaborateurs, par management qui propose d’être partie prenante du projet : avec un équilibre entre fournisseurs/ clients / collaborateurs. »

« La notion de partage est primordial au CJD complète Natacha Poncet, vice-présidente de l’association. Nous partageons nos émotions _ pour nous connaître et avancer. Suivre son instinct, son intuition, c’est oser, c’est vivre pleinement » Et Julien s’inscrit pleinement dans cet état d’esprit ! »

Un Chef porté par ses souvenirs et émotions d’enfance

Julien Duboué marche à l’envie et aux idées, porté par l’image de ses grands-parents et parents qui cultivaient tout dans son village, où le troc des œufs contre du beurre était normal.

Quand on lui demande quelle est sa vision de la production, il nous répond simplement que c’est celle des 80 ha du Sud-Ouest où sont cultivés tous les fruits et légumes de ses restaurants.

Sa vision de la cuisine ? C’est celle de ce qui est bon à partager entre amis et en famille, avec au minimum 15 personnes ! Ce sont aussi des plats qui mijotent dans le four à pain de Boulom, comme mijotait le jarret de porc dans le four à pain de son village d’enfance pour les grandes tablées du dimanche.

Brut, ancré dans le sol, dans ses émotions et ses convictions fortes, l’âme volontaire chevillée au corps, le Chef Duboué construit ses restaurants depuis 15 ans pour partager sa passion.

Sa passion du terroir et des bons produits se veut accessible à tous les porte-monnaies. Dans son dernier concept BOULOM – Boulangerie où L’on Mange, à Paris dans le 18e, la Boulangerie au four au pain précède le buffet a volonté – délicieux !!- et paraît-il, pour les fins de soirées, une porte secrète – on se croirait dans Alice aux Pays des Merveilles, celle d’un frigo – où se cache un bar a cocktails !

Le Chef nous confie qu’il peut piquer des colères… On a du mal à le croire ! « Rassurez-vous, elles ne sont jamais bien graves car je bosse avec mes amis d’enfance. Ils me soutiennent depuis ses débuts. Mes premiers associés ! »

Le choix de faire partager les fruits des bénéfices à ses salariés

Julien nous confie ses rendez-vous avec des investisseurs au 20e étage d’une grande tour avec tous ces messieurs en cravate… Et ce sentiment d’étouffer, de redescendre sur cette terre qu’il aime tant.

Ses interrogations et puis finalement la décision de dire « non ».

Le choix de faire partager les fruits des bénéfices à ses salariés en donnant des parts du gâteau.

Chez Julien on commence à la plonge et on termine assistant boulanger comme Bacca qui en 12 ans a fait une ascension progressive et sûre. Chez Julien, passer par le terrain, mettre les mains dans la terre et le cambouis, c’est une philosophie de vie. C’est aussi avoir la possibilité de grandir, de « bosser comme des dingues » en équipe et de monter les échelons.

Jeudi dernier, Julien ne nous a pas donné une leçon de management ni une leçon de storytelling bien rodé. Il nous a livré ses interrogations d’entrepreneur, ses coups de cœur et ses coups de gueule, et l’héritage humain, simple et responsable qu’il tient de ses parents !

Il nous a donné de l’envie, celle de se relier à ses intuitions, quitte à parfois ne pas suivre les grandes tendances de management ou d’investissement. Et plutôt d’oser les questionner et de suivre d’autres voies ! Grand Chef, grand entrepreneur par ses valeurs et sa réussite, nous étions tous touchés par sa simplicité, son authenticité.

Doux, doué, brut !

Par Clémence DELORME, Responsable Influence CJD 92

Pour en savoir plus sur Julien https://www.julienduboue.com/, https://www.facebook.com